Title: The Legacy Journey

Author: Dave Ramsey

Genre: Finance/Christian

Publisher: Ramsey Press

Rating:

Dave Ramsey is a legend in the Christian finance world. With critical terms like baby steps, emergency funds, and sinking funds, almost everyone has heard something about what he teaches, even if not directly from him. But if you are like me and have taken years to save that emergency fund, pay your debt off a time or two, and even make it through saving up 3-6 months worth of expenses, you are probably wondering, What is next? So as someone who has not only followed Dave Ramsey’s baby steps but has co-lead multiple Financial Peace University classes, I wanted to know what the other side looked like. That is what The Legacy Journey is about. What does building wealth and giving really look like? Dave Ramsey not only goes through those details but also provides the biblical background on why and how God has called us to build wealth and give.

My Thoughts:

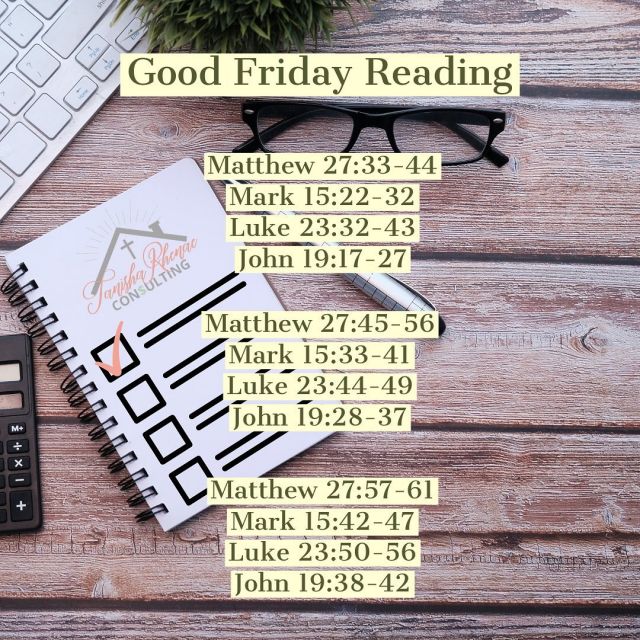

One of the first things that jumped out at me about this book was how often Ramsey backed up his principles with Scripture. And not only pulling one verse to push his ideas, but he really took the full context of multiple passages and then created his principles. It was evident the amount of time that Ramsey took studying and actually living out what he preached. I was thankful that he didn’t take too much time to rehash the lessons from his previous books (which covers all the baby steps in detail but more so focuses on baby steps 1 through 3). You get brief backgrounds on his history of becoming a millionaire and then having to file bankruptcy and build his wealth again God’s way. You get plenty of examples of the millionaires and billionaires that he has spoken with and how they can focus on giving once they reached those statuses. And I know sometimes it can seem like we are way far off from being a millionaire and for sure a billionaire, but Ramsey gives what I like to call real people examples as well that lets us know these goals are possible.

Ramsey starts with the reminder that we don’t truly own anything, including our wealth. God is the owner, and He entrusts us to steward and manage money properly. Ramsey then introduces the NOW-THEN-US-THEM concept. NOW is all about budgeting and taking care of your family. THEN is when you move on to focusing on your future by saving, investing, and paying off more substantial assets like your house. US is about preparing your family for legacy building and turning that future planning into creating generational wealth. THEM is community and giving focused. He also tackles the debate on whether Christians should be wealthy or not. He talks about biblical rumors that are generally thrown into the discussion (like money is the root of all evil…no, the love of money is the root of all evil – see 1st Timothy 6:10). He gives statistics showing how even though Jews are a small part of the US population, they make up a good part of the Forbes 400 list (2% compared to 25-30%). What are they doing? Following the biblical principles to gaining wealth and being generous once they have it. Ramsey reminds us of all the wealthy men and women in the Bible and shows how God was the reason for their blessings and wealth.

Our mindset on wealth and how we teach our children about wealth are also focused on in this book. Everything from pride, humility, and gratitude is touched on. Not only do we have to plan what to do with our money so we can build wealth, but we also need to be intentional with what we say and show to our children. If we plan to pass down our wealth to them as the Bible says, we need to ensure that they manage it well also so they can pass it down. Ramsey outlines how to balance the biblical command of being a hard worker with also being content with what we have and where we are in life. Does that mean we shouldn’t strive for more? No, but it does mean that we should enjoy what we have and be thankful to God for giving it to us. Setting goals and our work are essential as well. Ramsey is a firm believer that anyone can become a millionaire with hard work and planning. He also believes in positive thinking and speaking life, which was a huge confirmation for me when I was questioning affirmations and manifesting as a Christian. (head to this post to see more on that) You will learn why nonprofits shouldn’t get all your money, why wills are important, why it’s okay only to pay what you owe in taxes and how to create a family constitution that will be your guide throughout this legacy journey.

Another principle that was new for me was the idea of ratios. Instead of setting specific dollar amounts for your overflow, which is where you will find your additional giving, investing, and living, you set ratios for those areas. So basically, once you start getting towards the end of the baby steps (most likely baby step 7 – Build wealth and give), its time to decide what amount you can reasonably live on. I’ll use one of his examples that seem more realistic. You make $80,000 a year as a family but decide you can live on $50,00 a year. Now you would apply the ratios to the remaining $30,000. As a believer, you are giving 10% as a tithe. You would then decide what percentage you are comfortable with for additional giving (whether that is to the church or charity). He also recommends planning for taxes. A part of your overflow should also go to investing. And finally what he calls extra lifestyle which is where you get to enjoy your money. For a family that has an income of $10,000,000 a year, they decided they could live on $400,000 a year. That leaves them with $9,600,000 in overflow. Here is their ratio breakdown:

10% Tithe = $960,000

40% Taxes = $3,840,000

10% Extra Giving = $960,000

35% Investing = $3,360,000

5% Extra Lifestyle = $480,000

100% = $9,600,000

You can see that with the ratios, no matter what your overflow amount is, as long as you are comfortable with your percentages, you are covered.

Ramsey also walks us through four areas using three lenses that, when we help strengthen these foundations, can help prepare us for wealth. The four areas are your personal life, your marriage, your children, and other relationships. The three lenses all four areas will go through are ownership, magnification, and community. The first and foremost thing when it comes to building your wealth, as Ramsey has already shared, is managing yourself. Reminding yourself that you don’t have any ownership and that it all belongs to God. Getting more money will only magnify who and what you already are. And the community you build at this stage should include a teacher, a student, and a friend. (A bit of a tangent – here is where Ramsey talks about him and a group of his 12 closest friends that meet every week for an hour and a half to chat, check-in with each other, study the Bible or read books. And they have done this for over a dozen years. Can I just say, I added this to my prayer list?) Secondly, if you are married, you are a team and as one flesh need to do this wealth-building thing together. To avoid the focus being on “me” and “mine” in these discussions, you again are reminding each other that it all belongs to God. Everyone knows that finances are a significant cause of marriages going astray. Having more money will not change that aspect. Building a solid foundation in your marriage first helps alleviate many problems in advance. It’s essential to build a community that consists of other couples at your financial level and maintain those life long friendships that you have created. Thirdly, teach, and show your kids how to manage the wealth that hopefully, you will be passing on to them. Teach them early on that all things belong to God. Your children’s personalities will just be magnified when they receive and build wealth. And it’s just as vital for them to have positive influences in their community as it is for you. Lastly, your other relationships will be impacted by your increase in wealth, and its best to plan for that. You do not owe anyone anything just because they are your family. And people’s real personalities come out, the more money there is to be spread around. Setting boundaries will impact your community, but don’t worry, those friends you built at your wealth level will be able to support you through this.

I challenge you to turn this book into a Bible study on generosity and biblical wealth. Take time to really soak in the principles and the Scriptures behind them. Invite God into your finances and allow the Holy Spirit to lead you. This book has led to many prayers and conversations with my loved ones and friends. While it may be difficult to imagine in the early baby steps, I do still recommend everyone reads this book as it will help with motivation and seeing the end goal. Biblical and generation wealth are gifts that I want to plan to give my future children and their children. This book did its job to help me better understand what that looks like and how to accomplish it. And for that reason, it gets 5-stars from me.