There was a meme recently that said, do you ever feel like you want to get your whole life together at 2 am? That’s me. I consistently think of all the things I forgot to do and all the things I need to do in the middle of the night. I can’t do this for another month. I have got to get my life together!

Back in the day, I had it all together. Or at least I thought I did when I was a planner. I loved all things planning. I liked knowing what to expect. It became like a brain dump for me and allowed me to take stuff out of my mind and put them somewhere before I forgot them.

I remember using the agenda’s they gave you in school from a very early age and usually had a cheap one anytime I was taking college classes.

I graduated to the big leagues of planners when I got my first Erin Condren back in 2013/2014, and I haven’t looked back since when it comes to paper planners.

I also, over the last year or two, have found a love and appreciation for using technology to plan. My google calendar tends to keep me on schedule with its alerts and reminders.

But as a housewife and a budding entrepreneur, I don’t have a strict schedule that I am forced to adhere to anymore. That has shaken up my planning routine a bit. I’m mostly relying on to-do lists (or completed lists) and just don’t feel as productive as I could be. With me wanting to be intentional with keeping my home and faith a priority while working on my entrepreneurship adventures, I know planning for me is what will help me find the harmony in doing all of those things.

I decided to sit down and plan the month of May. But I wanted to go a little beyond what I have been doing as of late, which is just writing down appointments, meetings, and webinars. I looked at what I wanted to accomplish this month:

- I want to keep home a priority

- I want to keep my relationship with God a priority

- I want to make sure our finances are stable

- I want to cook from what I have in the house already before my next grocery order

- I want to be more consistent on the blog and social media

I knew these would be things that I need to “schedule” in if I wanted to accomplish them. So I grabbed May’s calendar from my Erin Condren binder system and stared at it.

How do I get this blank calendar to bring me comfort with the five things that I had listed? Let me break down my thought process for each one and show you what I did.

Keeping Home a Priority

Keeping Home a Priority

How do I do this? For me, it is making sure our house is clean, and our home has a calming atmosphere and is a sanctuary for us to relax in.

I’ve decided to follow the FlyLady program again when it comes to cleaning and decluttering our home. So I will use her routines and calendar to help me focus on what needs to be done cleaning wise.

Keeping God #1

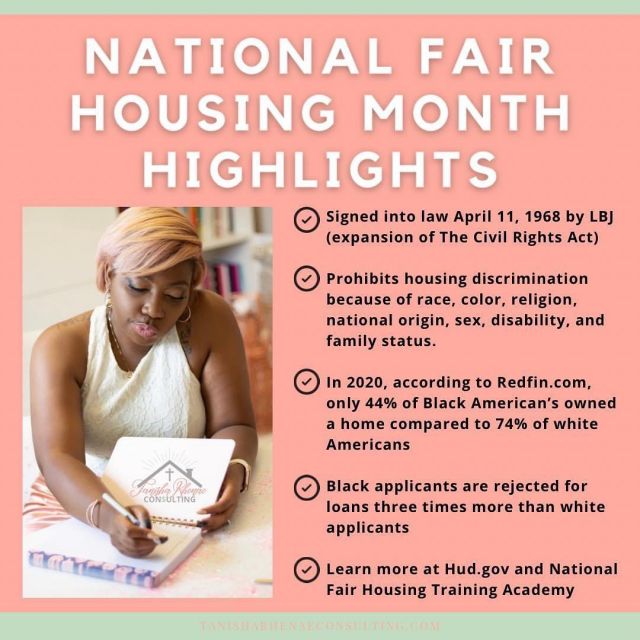

The way that I build my relationship with God is by spending time in His Word, praying, and worshiping. I also attend church each week.

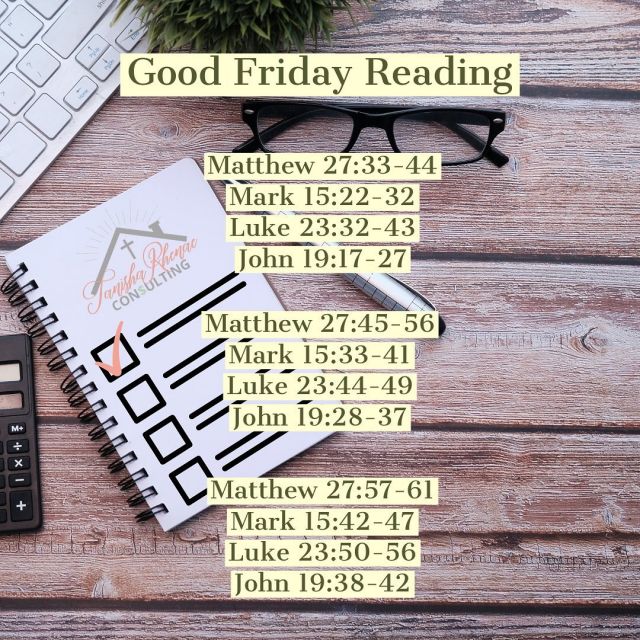

Bible reading and studying is a passion of mine. I love learning more about God and what His plan is for His children. For me, this is a daily practice. At the end of April, I finished my Day by Day Chronological Bible, which is what I was using for my daily reading. But now that I have read the full Bible (and the NT twice), in less than 12 months, I decided it’s time to really add studying to my routine.

In May, I want to focus on one to two chapters a day for my studying. I want to allow room for God to truly teach me His Word and see what fruit comes from that knowledge. I will most likely be using the Dayspring Illustrating Bible. And because I know I prefer to also get in additional reading, I am following along with Annie F. Downs and reading the four gospels each month, in a different translation. In May, I am starting with the NASB translation and am just using the YouVersion Bible app.

I want to do better with praying for groups of people. I currently have a list in my reminders app and want to be more consistent with praying over it. My list includes The Church (body of Christ, church leaders, and missionaries), Chris and our future children/legacy, family, friends, unbelievers, our nation, and the world.

I also want to go back to the practice of reviewing the sermon and my notes from Sunday. I use to try and rewatch the message during the week, make sure I didn’t overlook any relevant notes, and then transfer what I learned to my ESV Journaling Bible. I haven’t done that in a while, and I miss the reinforcement of the message from my pastors.

Keeping Our Money Healthy

Keeping Our Money Healthy

If you have seen our budgeting spreadsheet, you probably think it is a beast to maintain. And while that can be the case, thanks to me doing budget reviews every week, it isn’t that difficult. In less than 30 minutes, I update it with the previous week’s transactions, have a conversation with Chris, and set our goals and intentions for the next week.

We Have Food At Home

We Have Food At Home

I hate meal planning mostly because I cook based on our cravings. I try to keep a variety of items stocked at the house to make that possible. But I haven’t been doing a great job lately of making us balanced meals. And I’ve been stuck on more than one occasion on what I should cook. So I decided to venture back into meal planning.

Consistency is Key

I have no idea why I struggle so much with this. Well, I kind of do.

Honestly, I am 75% over social media. I have worked hard to curate what I have coming into my feeds, but there can still be a lot of junk. And because I don’t want to see that, I stay away from the apps. Which is a problem when I love sharing and connecting with others.

And as for my blog? Perfectionism, my friend. This is draft post number 46. Now to be fair, some of those are future projects. But a lot of them are ideas that I have for a blog post, and during the process of fleshing them out, perfectionism has paralyzed me.

So I need to overcome this by planning out my content for the month and sticking to it.

See What I Did There?

My blog and social media are how I share and connect with people. I share what I am currently going through and what I am currently working on. So when it comes to planning out the content for May, I kind of just did that with this post. My blog and social media posts, in a way, help keep me accountable. If I know that I want to post what I learned from the sermon on Sunday, I have to be sure I did the review of my notes. Now, to be clear, I am not doing these things for the blog or social media. I am doing these things for me and am choosing to share them after the fact in hopes that they help others that may be struggling with finding harmony with all the things they are trying to manage in life.

Finally, since I used my Erin Condren monthly pages as my draft, I went ahead and added these to my Tanisha Rhenáe google calendar. Now I know what my end goal is and can set up alerts to help me remember. If you read this post here, you know that I am using time blocking to help make my day more productive. That means instead of just randomly jumping from task to task, I put like items together and focus on only those items until the next block. So while the doing of my five goals will be done in either my Homemaking or Admin block, I will use my Content Creation block to build these out for my blog and social media.

Let me know in the comments below what your biggest struggle is with planning?

*I included my Erin Condren referral link in this post. In addition to you getting $10 off your first purchase, I earn rewards as well!

*As an Amazon Associate, I earn from qualifying purchases using the links included in this post.

YouTube Channel Name:

YouTube Channel Name: